Amendment to VAT Exemption for Electric Vehicle Chargers

08

Oct, 2024

An amendment to Article 164.1.41-2 of the Tax Code of the Republic of Azerbaijan has extended the VAT exemption on electric vehicle chargers:

References

https://e-qanun.az/framework/58130

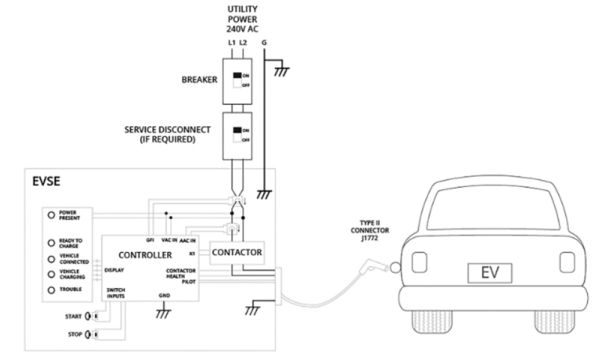

- Scope of Exemption: Import and sale of second-level and third-level electric energy chargers for electric vehicles.

- Updated Duration: The VAT exemption, effective from 2022, will now apply for 5 years instead of the previous 3 years.

| Year | 2021 | 2022 | 2023 |

|---|---|---|---|

| Number of Electric cars imported | 160 | 486 | 3,102 |

Recent Articles

Transition to the “e-Bulletin” System Starts on May 1

From May 1, 2025, Azerbaijan is switching to fully digital sick leave documen…

Amendments to the Decree on Exemption from Imported VAT for Raw Materials and Materials, approved on April 7, 2025

The amendments to the Decree on the List of raw materials and materials exemp…